tax deductions for high income earners 2019

How To Reduce Taxable Income For High Income Earners In 2021. Thanks to the new tax law the deductions have been.

Tax Strategies For High Income Earners Wiser Wealth Management

The annual deductible for all Medicare Part B beneficiaries is 185 in 2019 an increase of 2 from the annual deductible 183 in 2018.

. The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes several provisions. This is up from 6303000 in 2019. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year.

Tax Deductions For High Income Earners 2019. Long-term capital gains tax. IRS Tax Reform Tax Tip 2019-28 March 21 2019.

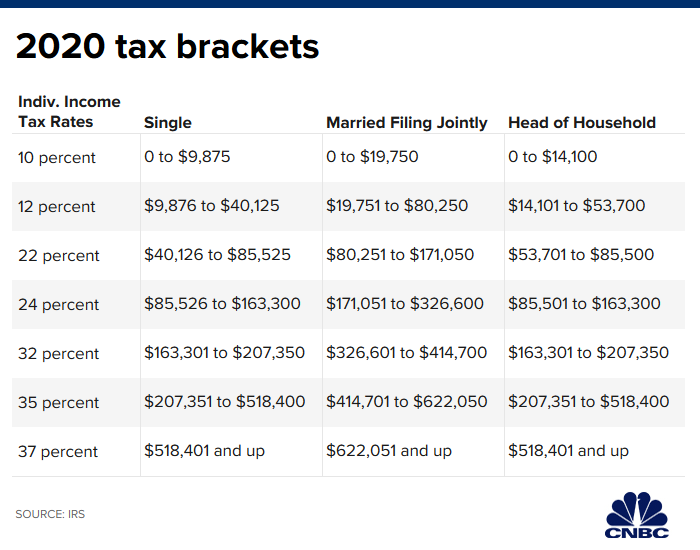

Gift and estate deductions help bring down taxable income but there is even more reason to take advantage of them now. Tax deductions for high income earners 2019 Tuesday June 14 2022 Edit. But the tax changes are only temporary and increased the standard deduction for individual and joint filers alike.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. The age for required minimum distributions rmds from retirement accounts was. The benefit of credits and exemptions is also reduced as income rises.

Ad Easy Software To Help You Find All the Tax Deductions You Deserve. WASHINGTON The Internal Revenue Service today urged high-income taxpayers and those with complex tax returns to check their withholding. Whereas that deduction used to be unlimited its now capped at 10000 a year.

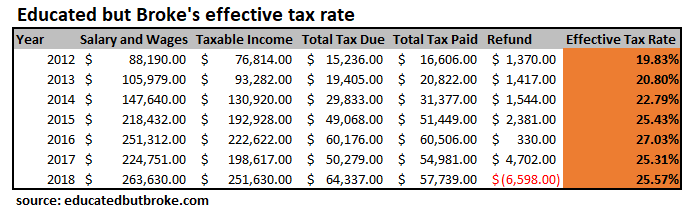

It would look like the following. 5 Outstanding Tax Strategies For. The average household income was.

What was the average household income. Premiums and deductibles for. What was the average household income in 2019.

The SECURE Act. The deduction is meaningful with 5000 for single filers and 10000 for married couples filing jointly. Division 293 tax is an additional tax on super.

The next two largest deductions claimed by high-income households in 2014 were the charitable deduction 108 billion and the home mortgage interest deduction 63 billion. Tax law changes in the Tax Cuts and Jobs Act affect almost everyone who itemized deductions on tax returns they filed in. Premium Federal Tax Software.

Its possible that you could. In 2022 a higher standard deduction of 12950 for individuals. These include mortgage interest and property tax deductions and deductions for charitable contributions.

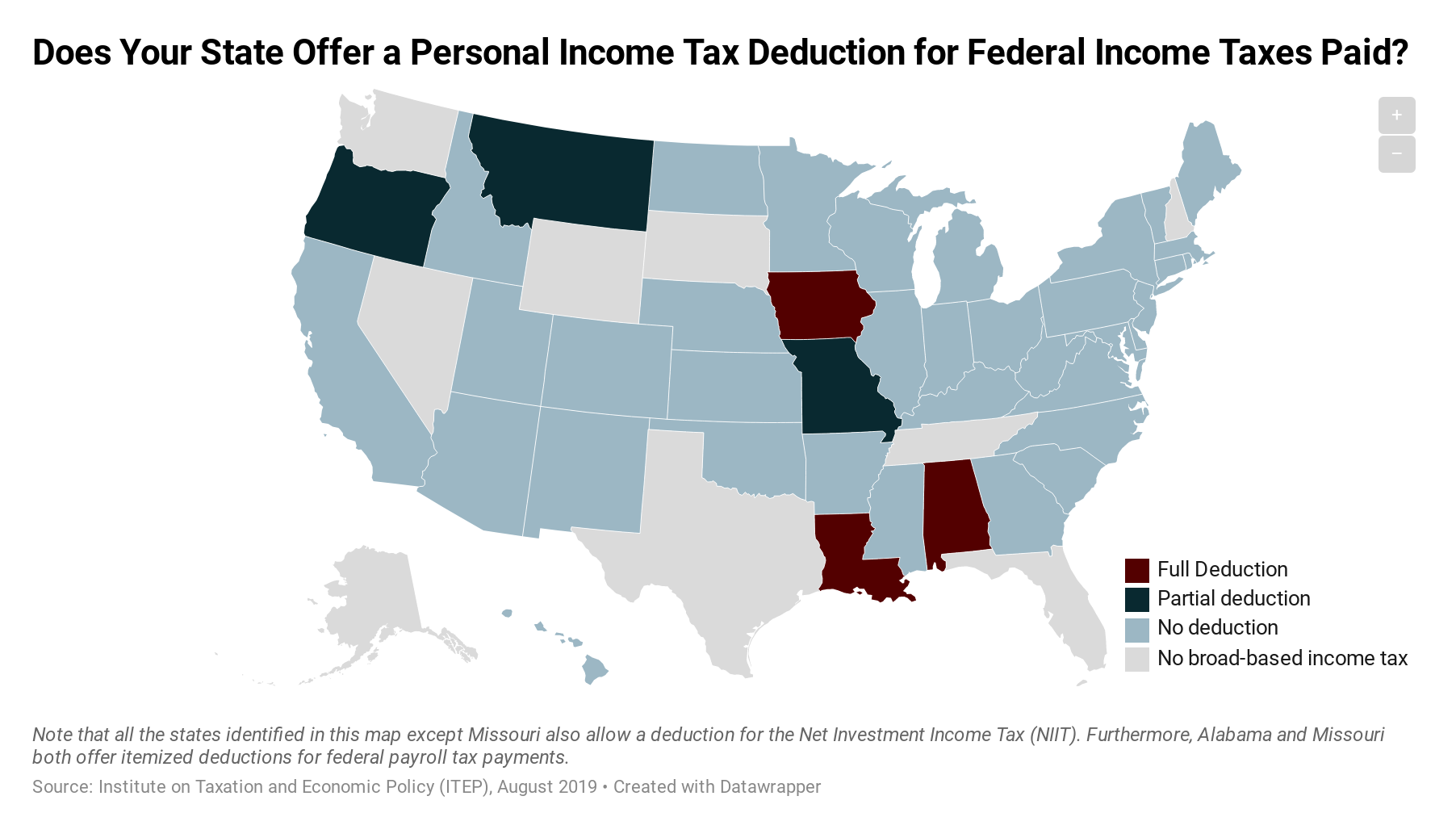

The good news is that with a combination of tax deductions tax credits and contribution strategies you can reduce your tax bill by reducing your taxable income. In Georgia however the deduction is only 2000 for individuals and.

The 6 Best Tax Deductions For 2019 The Motley Fool

Here S A Breakdown Of The New Income Tax Changes

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

4 Tax Breaks For High Income Households The Motley Fool

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Taxes Are Still Too Damn High Taxing High Income Earners Who Live In By John Cook Medium

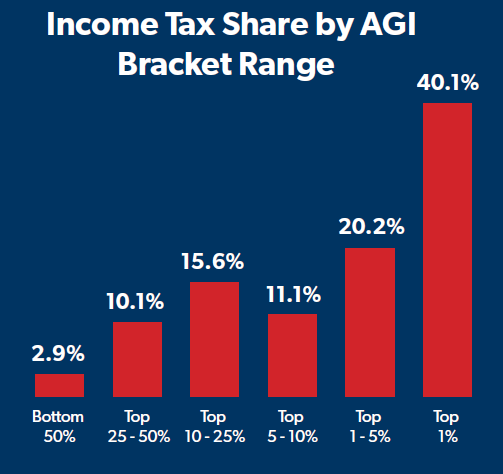

Summary Of The Latest Federal Income Tax Data Tax Foundation

How Does The Federal Tax System Affect Low Income Households Tax Policy Center

The Marriage Tax Penalty Post Tcja

Chiropractic And How To Reduce Taxes For High Income Earners

Who Pays Income Taxes Foundation National Taxpayers Union

How Do Taxes Affect Income Inequality Tax Policy Center

5 Tax Deductions For High Earners Plus A Tax Hack The Physician Philosopher

Middle Income Earners In Arizona Could See Slightly Smaller Tax Bills For 2019

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Tax Reduction Strategies For High Income Earners Pure Financial

The Hierarchy Of Tax Preferenced Savings Vehicles

How Democrats Would Tax High Income Professionals Not Just The Mega Rich The New York Times